Welcome to the magical world of investing, where starting early can turn a modest sum into a king’s ransom by the time your little bundle of joy is ready to step into adulthood. Imagine if you could give your child a future filled with choices—attending any college, purchasing their dream home, or even retiring before they start complaining about back pain. Sounds like a fairytale? It’s not! Here’s how a custodial investment account can turn your newborn into a millionaire by the time they need to worry about mortgage rates and college tuition.

Chapter 1: The Golden Ticket to Ivy League

The first and perhaps most celebrated checkpoint in your child’s life will be education. The cost of college tuition can be daunting. However, with a custodial investment account started at birth, you’re setting up a growing fund that could cover their education from Harvard to Hogwarts! By investing even a small amount regularly, your money benefits from what Albert Einstein allegedly called the “eighth wonder of the world” — compound interest.

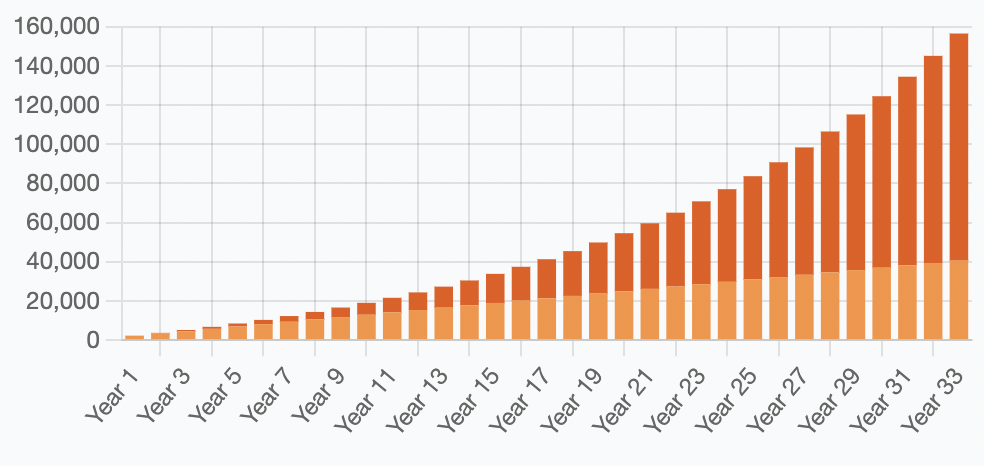

If you start with an initial deposit of $1,000 and contribute $100 every month until your child turns 18, assuming an average annual return of 7%, you’ll have around $41,000. That’s a significant chunk of college fees sorted or a full ride at numerous prestigious institutions if combined with scholarships.

Chapter 2: There’s No Place Like Home

Fast forward a few years, your now-grown-up kid decides it’s time to buy a house. The national average age for first-time home buyers hovers around 33. With continued investment in the custodial account until then, and keeping up with the same investment strategy, you’d see that initial fund bloom into approximately $100,000 or more by their 30s. This hefty sum can serve as a formidable down payment on their first home, making the difference between a fixer-upper and their dream home.

Chapter 3: Retire While You’re Young Enough to Enjoy It

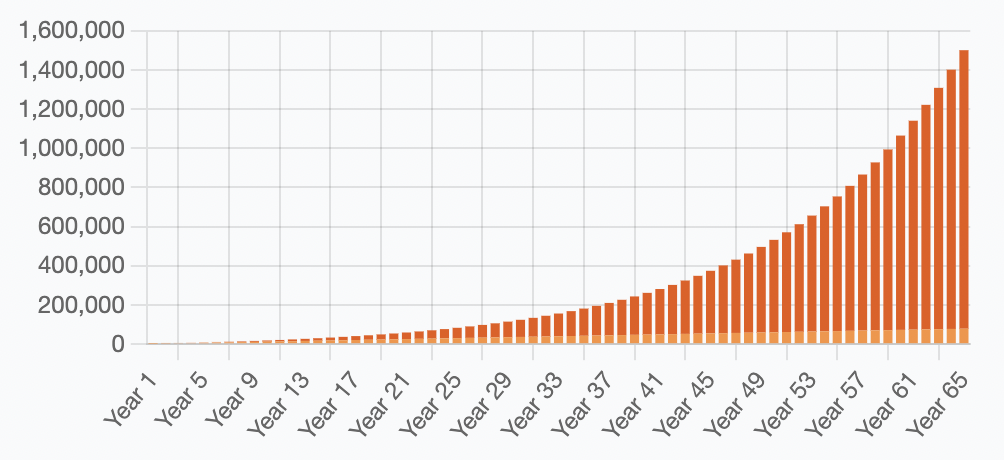

Let’s dream bigger. If the investment remains untouched till retirement, your child will witness the sheer might of long-term compound interest. Continuing the trend till the age of 65, assuming the contributions stay constant and the market remains stable at a 7% return, the humble beginnings of that custodial account could grow to well over $1 million. Yes, you read that right! That’s a retirement cushion that promises comfort, security, and maybe a beachside home in Florida or frequent trips to Europe.

Getting Started: Your Map to Buried Treasure

Now that you’re daydreaming of your child’s golden years, let’s get down to brass tacks. Setting up a custodial investment account is easier than you might think:

1. Choose the Right Type of Account: You can opt for a UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act) account. Both allow you to invest in stocks, bonds, mutual funds, and more.

2. Pick a Broker or Financial Institution: Look for providers that offer custodial accounts with low fees and a wide range of investment options. Companies like Fidelity, Vanguard, and Charles Schwab are popular choices.

3. Open the Account and Start Investing: You’ll need your and your child’s Social Security numbers. Decide if you want to make a lump sum deposit or set up regular transfers. Then, choose your investments based on your long-term goals and risk tolerance.

4. Monitor and Adjust: Keep an eye on the account’s performance and adjust your investment choices as needed based on market changes and your child’s changing needs.

5. Educate Your Child: As they grow, involve your child in the decisions and teach them about investing. This not only helps them appreciate the value of money but also equips them with knowledge to manage their fortune wisely.

By opening a custodial investment account for your child at birth, you’re not just saving money; you’re investing in their dreams. From elite education to comfortable retirement, you are setting up your child for a life filled with options and financial security. And who knows? They might just be the next Warren Buffet, all thanks to your foresight. So, grab that treasure map, and start the journey — your child’s future awaits, and the skies are bright!

Are you interested to learn how new parents can crowdfund an investment account for their child at birth? Visit MyKidStarter.com to learn more.